Market Outlook

July 26, 2019

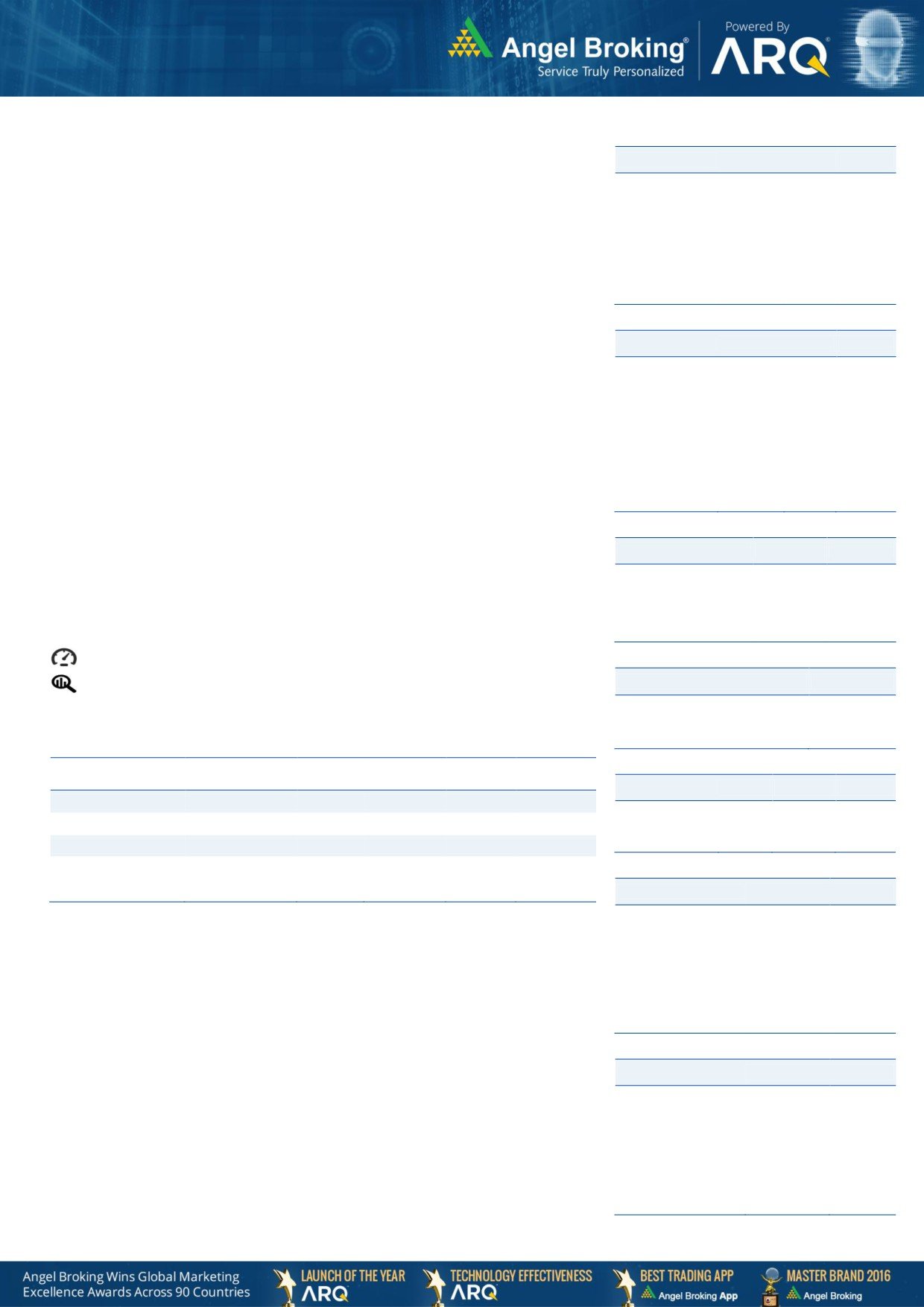

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are likely to open flat tracking global indices and SGX Nifty.

BSE Sensex

(0.1)

(17)

37,830

Nifty

(0.5)

(60)

11,271

The US stocks moved mostly lower during trading on Thursday. With the drop on the

Mid Cap

0.5

73

13,782

day, the tech-heavy Nasdaq and the S&P 500 pulled back off yesterdays record

highs. The Dow slid 0.5 percent to 27,140 and the Nasdaq tumbled 1 percent to

Small Cap

(0.1)

(12)

13,031

8,238.

Bankex

0.3

110

32,780

U.K. stocks eked out modest gains on Thursday as investors digested a mixed bag

of corporate earnings and the news of a massive cabinet reshuffle as Boris Johnson

Global Indices

Chg (%)

(Pts)

(Close)

works to build a government dominated by Brexit loyalists. The FTSE 100 was up by

Dow Jones

(0.5)

(129)

27,140

0.2 percent at 7,518.

Nasdaq

(1.0)

(83)

8,238

On domestic front, Indian shares opened higher on Thursday, but later gave up all

FTSE

0.2

17

7,518

gains to end on a flat note as July derivative contracts expired. The benchmark BSE

Nikkei

0.2

47

21,756

Sensex fell by 0.1 percent to 37,830.

Hang Seng

0.3

70

28,594

Shanghai Com

0.5

14

2,937

News Analysis

World Bank investment arm to channel $200 mn into Shriram Transport

Advances / Declines

BSE

NSE

Finance

Advances

1,070

807

Detailed analysis on Pg2

Declines

1,370

1,015

Investor’s Ready Reckoner

Unchanged

163

106

Key Domestic & Global Indicators

Volumes (` Cr)

Stock Watch: Latest investment recommendations on 150+ stocks

Refer Pg5 onwards

BSE

2,045

NSE

39,451

Top Picks

CMP

Target

Upside

Company

Sector

Rating

(`)

(`)

(%)

Net Inflows (` Cr)

Net

Mtd

Ytd

Blue Star

Capital Goods

Buy

741

867

17.0

FII

(1,402)

(7,143)

74,418

ICICI Bank

Financials

Buy

409

490

19.8

*MFs

202

2,787

10,882

Parag Milk Foods

Others

Buy

261

330

26.3

Bata India

Others

Buy

1,301

1,643

26.3

KEI Industries

Capital Goods

Buy

452

612

35.4

Top Gainers

Price (`)

Chg (%)

More Top Picks on Pg4

986

6.5

1,148

5.6

47

5.2

462

5.1

NAUKRI

2,245

4.7

Top Losers

Price (`)

Chg (%)

29

-12.5

197

-8.3

20

-7.2

761

-6.1

235

-5.3

As on July 25, 2019

Market Outlook

July 26, 2019

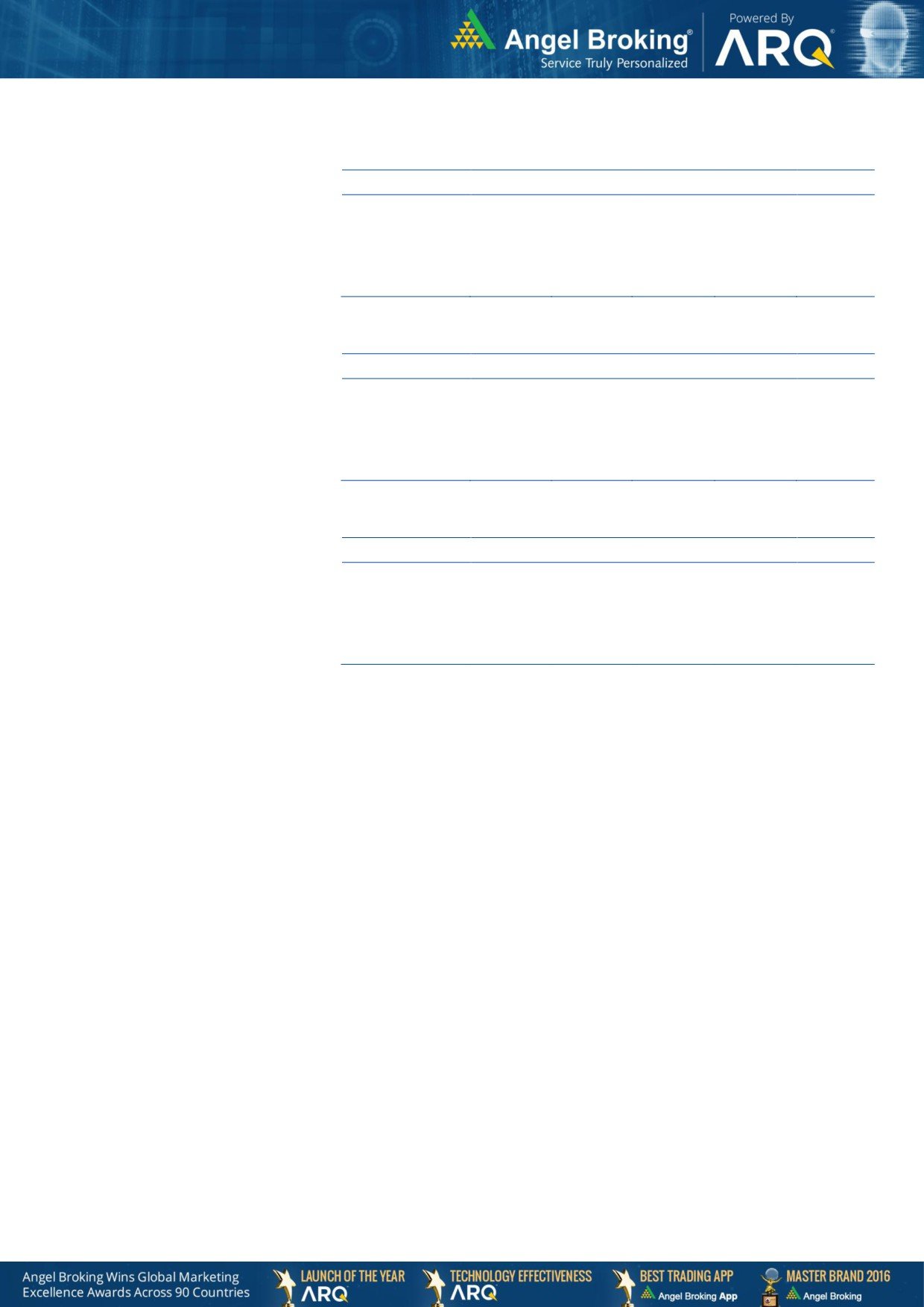

News Analysis

World Bank investment arm to channel $200 mn into Shriram

Transport Finance

crore) from International Finance Corporation and other investors through a

securitisation structure. IFC, the World Bank's private-sector investment arm, said

the structure would help mitigate foreign exchange risks and attract patient capital

from pension funds, insurance firms, and foreign institutional investors. Half of the

total amount will come from IFC’s own account and the rest will be mobilised from

like-minded partners. The first tranche of $82 million was disbursed on Thursday.

Half of which is from IFC’s own account. The proceeds will help Shriram Transport

meet its funding requirements and allow it to continue expanding its reach to

micro, small and medium enterprises, IFC said.

Umesh Revankar, MD and CEO, Shriram Transport Finance added that the funds

raised would be used to help the small commercial vehicle operators and MSMEs

in rural and semi urban markets. There is a huge growth opportunity in smaller

towns and the company will unleash the potential of these geographies. The

transaction comes at a time when NBFCs in India have been feeling a liquidity

crunch since September last year due to the Infrastructure Leasing & Financial

Services Ltd (IL&FS) crisis.

Economic and Political News

Bill to fine firms over corporate social responsibility tabled in Lok Sabha

Bond yields surge on buzz that PMO is opposed to sovereign bonds

Arbind Modi panel in 2018 suggested corporation tax cut; govt didn't accept

NCLT stays its own order to prosecute IL&FS auditors for four weeks

Corporate News

SoftBank announces new $108-billion Vision Fund with Apple, Microsoft

NCLT approves Patanjali's revised Rs 4,350-cr bid to take over Ruchi Soya

Monsoon delay hits sales of agri input companies in June quarter

Coal India clears over 44% rake backlog to non-power sector consumers

World Bank investment arm to channel $200 mn into Shriram Transport

Finance

Punjab National Bank plans to raise Rs 5,000-crore equity capital

Market Outlook

July 26, 2019

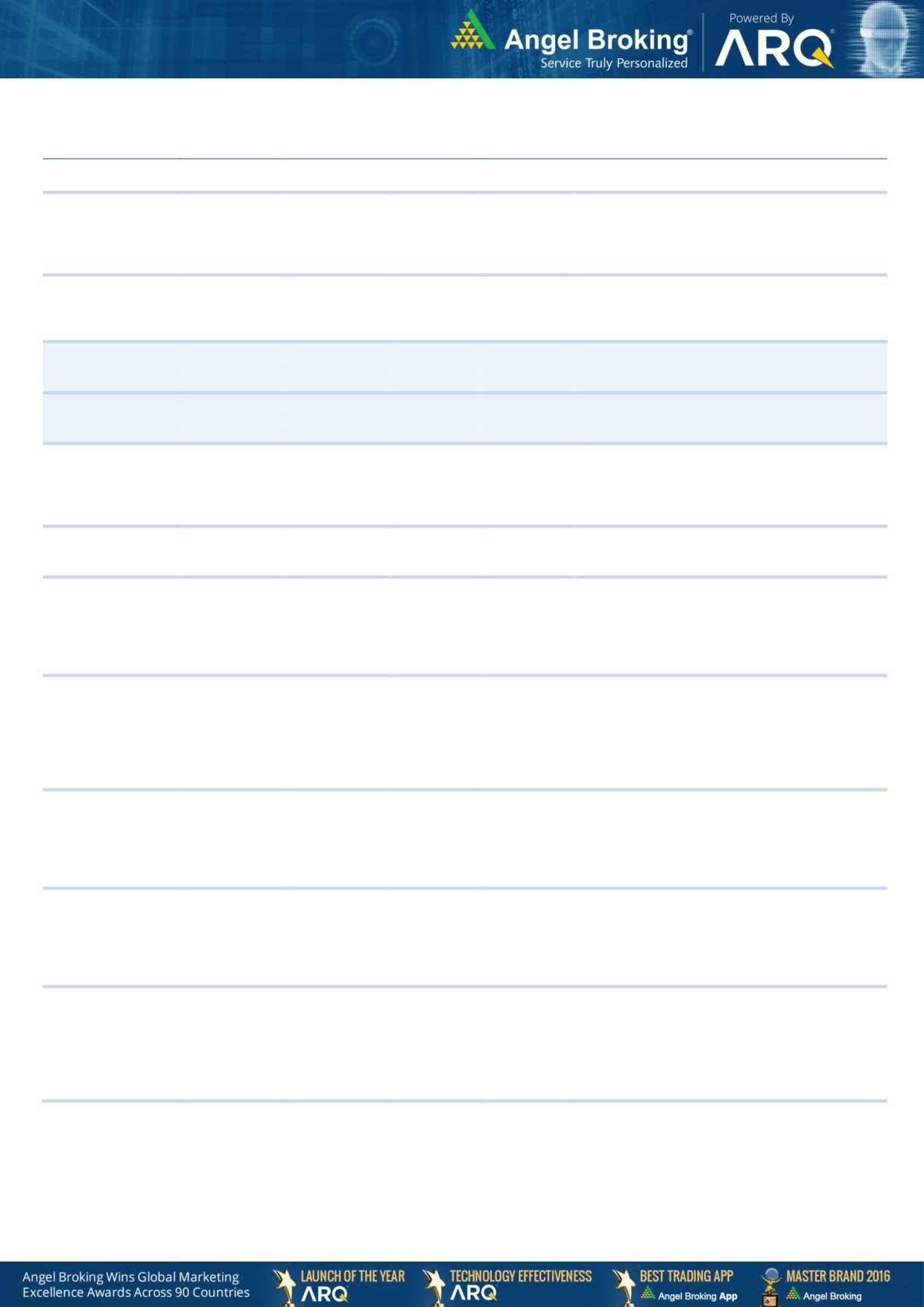

Quarterly Bloomberg Brokers Consensus Estimate

JSW Steel Ltd - July 26, 2019

Particulars (` cr)

1QFY20E

1QFY19

y-o-y (%)

4QFY19

q-o-q (%)

Sales

19,837

20,519

(3.3)

22,368

(11.3)

EBIDTA

3,793

5,105

(25.7)

4,407

(13.9)

%

19

25

20

PAT

1,150

2,366

(51.4)

1,495

(23.1)

Bajaj Auto Ltd - July 26, 2019

Particulars (` cr)

1QFY20E

1QFY19

y-o-y (%)

4QFY19

q-o-q (%)

Sales

7,792

7,419

5.1

7,395

5.3

EBIDTA

1,377

1,280

7.5

1,162

18.5

%

17

17

16

PAT

1,163

1,042

11.6

1,408

(17.4)

Maruti Suzuki Ltd - July 26, 2019

Particulars (` cr)

1QFY20E

1QFY19

y-o-y (%)

4QFY19

q-o-q (%)

Sales

19,155

22,459

(14.7)

21,459

(10.7)

EBIDTA

1,912

3,351

(42.9)

2,263

(15.5)

%

9

15

11

PAT

1,336

1,975

(32.4)

1,796

(25.6)

Market Outlook

July 26, 2019

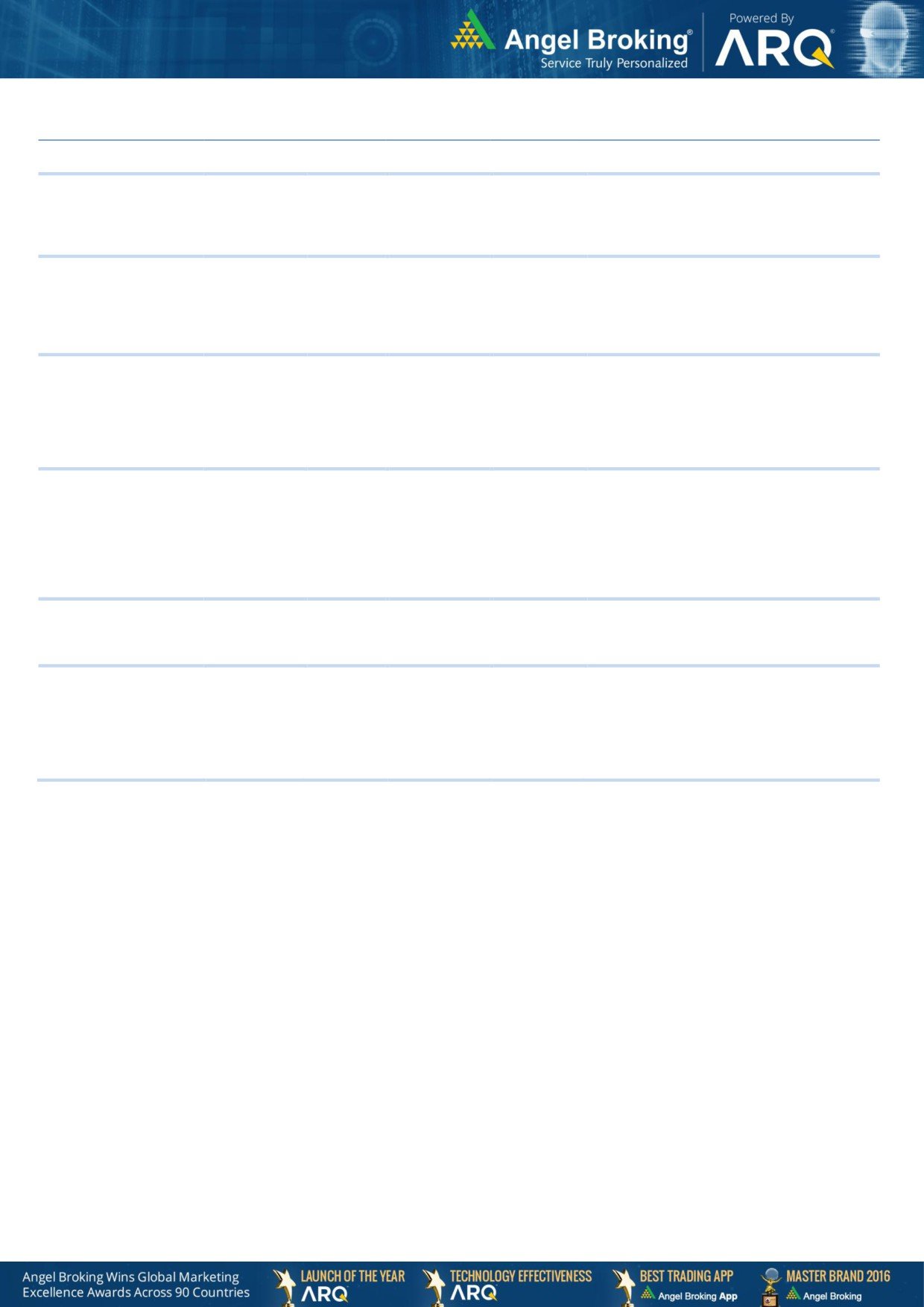

Top Picks

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Favorable outlook for the AC industry to augur well

for Cooling products business which is out pacing

Blue Star

7,135

741

867

17.0

the market growth. EMPPAC division's profitability

to improve once operating environment turns

around.

Well capitalized with CAR of 18.1% which gives

sufficient room to grow asset base. Faster

ICICI Bank

2,63,963

409

490

19.8

resolution of NPA would reduce provision cost,

which would help to report better ROE.

High order book execution in EPC segment, rising

KEI Industries

3,567

452

612

35.4

B2C sales and higher exports to boost the revenues

and profitability

GST regime and the Gujarat plant are expected to

Maruti Suzuki

1,74,009

5,760

8,552

48.5

improve the company’s sales volume and margins,

respectively.

Third largest brand play in luggage segment

Increased product offerings and improving

Safari Industries

1,287

577

1,000

73.4

distribution network is leading to strong growth in

business. Likely to post robust growth for next 3-4

years

We expect financialisation of savings and

Aditya Birla Capital

18,888

86

130

51.5

increasing penetration in Insurance & Mutual fund

would ensure steady growth.

One of the leading Indian dairy products

companies in India created strong brands in dairy

products. Rising revenue share of high-margin

Parag Milk Foods

2,198

261

330

26.3

Value Added Products and reduction in interest cost

is likely to boost margins and earnings in next few

years.

HDFC Bank maintained its steady growth in the

4QFY18. The bank’s net profit grew by 20.3%.

Steady growth in interest income and other income

HDFC Bank

6,24,999

2,286

2,660

16.4

aided PAT growth. The Strong liability franchise

and healthy capitalisation provides strong earning

visibility. At the current market price, the bank is

trading at 3.2x FY20E ABV.

We expect strong PAT growth on back of healthy

growth in automobile segment (on back of new

launches and facelifts in some of the model ) and

M&M

68,115

548

1,050

91.6

strong growth in Tractors segment coupled by its

strong brand recall and improvement in rural

sentiment

Market leader in the room air conditioner (RAC)

outsourced manufacturing space in India with a

market share of 55.4%. It is a one-stop solutions

Amber Enterprises

2,536

807

910

12.8

provider for the major brands in the RAC industry

and currently serves eight out of the 10 top RAC

brands in India

BIL is the largest footwear retailer in India, offering

footwear, accessories and bags across brands. We

expect BIL to report net PAT CAGR of ~16% to

Bata India

16,718

1,301

1,643

26.3

~`3115cr over FY2018-20E mainly due to new

product launches, higher number of stores addition

and focus on women’s high growth segment and

margin improvement

Market Outlook

July 26, 2019

Continued...

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

SHTF is in the sweet spot with benefits from

stronger CV volumes, NIMs unaffected by rising

Shriram Transport Finance

22,373

986

1,470

49.1

bond yields on the back of stronger pricing

power and an enhancing ROE by 750bps over

FY18-20E, supported by decline in credit cost.

We expect JSPL’s top line to grow at 27% CAGR

over FY19-FY20 on the back of strong steel

demand and capacity addition. On the bottom

Jindal Steel & Power Limited

13,707

135

250

85.7

line front, we expect JSPL to turn in to profit by

FY19 on back of strong operating margin

improvement.

GMM Pfaudler Limited (GMM) is the Indian

market leader in glass-lined (GL) steel

equipment. GMM is expected to cross CAGR

GMM Pfaudler Ltd

1,865

1,276

1,570

23.0

15%+ in revenue over the next few years

mainly led by uptick in demand from user

industries and it is also expecting to increase its

share of non-GL business to 50% by 2020.

Aurobindo Pharmaceuticals, amongst the

Indian Pharmaceutical companies, is well

placed to face the challenging generic markets,

given its focus on achieving growth through

Aurobindo Pharmaceuticals

32,439

554

890

60.8

productivity. Aurobindo will report net revenue

& net profit CAGR of ~13% & ~8% resp.

during FY2018-20E. Valuations are cheap V/s

its peers and own fair multiples of 17-18x.

We believe advance to grow at a healthy CAGR

of 35% over FY18-20E. Below peers level ROA

RBL Bank

19,532

455

650

42.9

(1.2% FY18) to expand led by margin

expansion and lower credit cost.

TTK Prestige has emerged as one of the leading

brands in kitchen appliances in India after its

successful transformation from a single product

TTK Prestige

8,102

5,845

7,708

31.9

company to offering an entire gamut of home

and kitchen appliances. We are expecting a

CAGR of 18% in revenue and 25% in PAT over

FY2018-20.

Maintain Hold.

Source: Company, Angel Research

Market Outlook

July 26, 2019

Fundamental Call

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

CCL is likely to maintain the strong growth

CCL Products

3,247

244

360

47.5

trajectory over FY18-20 backed by capacity

expansion and new geographical foray

We forecast Nilkamal to report top-line CAGR of

~9% to `2,635cr over FY17-20E on the back of

Nilkamal

1,486

996

2,178

118.6

healthy demand growth in plastic division. On the

bottom-line front, we estimate

~10% CAGR to

`162cr owing to improvement in volumes.

Elantas Beck India is the Indian market leader in

liquid insulation segment used in electrical

equipments like motors, transformers etc. It derives

Elantas Beck India Ltd

1,665

2,100

2,500

19.0

demand from several industries which are expected

to register 10%+ CAGR in demand in the coming

years. We can book out from the stock with 16%

profit at Rs. 2500 TP.

Greenply Industries Ltd (GIL) manufactures plywood

& allied products and medium density fibreboards

(MDF). GIL to report net revenue CAGR of ~14% to

Greenply Industries

1,593

130

256

97.1

~`2,478cr over FY2017-20E mainly due to healthy

growth in plywood & lamination business on the

back of strong brand and distribution network

L&T Fin’s new management is on track to achieve

L&T Finance Holding

20,435

102

210

105.6

ROE of 18% by 2020 and recent capital infusion of

`3000cr would support advance growth.

We expect loan book to grow at 24.3% over next

GIC Housing

1,293

240

424

76.6

two year; change in borrowing mix will help in NIM

improvement

Strong brands and distribution network would boost

Siyaram Silk Mills

1,213

259

549

112.1

growth going ahead. Stock currently trades at an

inexpensive valuation.

Expected to benefit from the lower capex

Music Broadcast Limited

1,410

51

95

86.3

requirement and 15 year long radio broadcast

licensing.

We expect Inox Wind to report exponential growth

in top-line and bottom-line over FY19-20E. The

growth would be led by changing renewable energy

industry dynamics in favor of wind energy segment

Inox Winds

1,284

58

120

107.4

viz. changes in auction regime from Feed-In-Tariff

(FIT) to reverse auction regime and Government’s

guidance for 10GW auction in FY19 and FY20

each.

Considering the strong CV demand due to change

in BS-VI emission norms (will trigger pre-buying

activities), pick up in construction activities and no

Ashok Leyland

21,209

72

156

115.9

significant impact on industry due to recent axle

load norms, we recommend BUY on Ashok Leyland

at current valuations.

Well planned strategy to grow small business loans

and cross-selling would propel fees income. We

Yes Bank

20,326

88

NA

NA

expect YES to grow its advance much higher than

industry and improvement in asset quality to

support profitability.